All Categories

Featured

Table of Contents

The round figure is determined to be the here and now worth of payouts, which means it would certainly be less than if the recipient continued the staying repayments. As an alternative, let's claim the proprietor chose a joint income, covering the owner's and a spouse's lives. The owner can pick an attribute that would certainly continue settlements of 100% to the enduring spouse or pick a various percentage, such as 50% or 75% of the initial repayment.

As an exception to the five-year regulation, the internal revenue service additionally allows you to extend the settlements out over a period not surpassing your life span. This alternative might not be offered in all agreements, nonetheless, and it isn't available when the beneficiary isn't a living individual, such as a trust or charity.

Partners and specific various other beneficiaries have added choices. If you choose this option, you can proceed with the initial terms of the annuity contract as though the annuity were your very own.

Acquired annuities are taxed to you as the beneficiary. The exact tax obligation ramifications differ depending upon the sort of annuity, your tax obligation status and the picked payment. To comprehend the tax obligation effects of inherited annuities, it is necessary to initially comprehend the difference between professional and nonqualified annuities. The distinction in between these two kinds of annuities isn't due to agreement terms or framework yet how they're purchased: Certified annuities are acquired with pretax bucks within pension like.

Payouts from nonqualified annuities are just partly taxable. Considering that the cash made use of to acquire the annuity has currently been strained, just the portion of the payout that's attributable to revenues will certainly be consisted of in your revenue. Just how you choose to receive the survivor benefit is additionally a consider identifying the tax effects of an inherited annuity: Taxation of lump-sum payouts.

Tax rules for inherited Index-linked Annuities

This is usually the least reliable payment option for tax purposes. That's particularly true if the fatality benefit is large sufficient to raise your gross income and place you in a higher tax bracket. Tax of repayment streams. When the fatality benefit is paid out as a stream of payments, the tax obligation liability is expanded over numerous tax obligation years.

For a certified annuity, the whole repayment will certainly be reported as taxable. If you acquire an annuity, it's important to think about tax obligations.

Are Period Certain Annuities taxable when inherited

Acquiring an annuity can provide a superb chance for you to make development toward your goals. Before you determine what to do with your inheritance, think concerning your goals and exactly how this money can aid you achieve them. If you currently have an economic strategy in place, you can begin by examining it and taking into consideration which goals you may intend to get ahead on.

Everybody's circumstances are different, and you require a strategy that's personalized for you. Connect with a to review your inquiries regarding inheritances and annuities.

Find out why annuities need recipients and how inherited annuities are handed down to recipients in this article from Protective - Multi-year guaranteed annuities. Annuities are a method to guarantee a regular payment in retired life, but what happens if you die prior to or while you are getting payments from your annuity? This article will certainly discuss the essentials of annuity survivor benefit, including who can receive them and how

If you pass away before initiating those settlements, your loved ones can accumulate money from the annuity in the kind of a survivor benefit. This makes sure that the beneficiaries gain from the funds that you have saved or spent in the annuity agreement. Beneficiaries are necessary because they collect the payment from your annuity after you die.

!? The annuity death benefit uses to recipients independently of the will. This implies the annuity benefit goes to the most just recently marked primary recipient (or the additional, if the key beneficiary has actually died or is incapable of gathering).

What taxes are due on inherited Annuity Beneficiary

That makes it a lot more complicated to get the annuity funds to the planned person after you pass. In a lot of states, an annuity without a recipient comes to be component of your estate and will be paid according to your will. That includes a probate process, in which a deceased person's residential property is assessed and their will validated before paying any exceptional tax obligations or financial obligations and after that distributing to beneficiaries.

It is exceptionally hard to test a standing agreement, and the bar for showing such a situation is extremely high. What occurs to an annuity upon the death of an owner/annuitant depends upon the kind of annuity and whether annuity repayments had actually initiated at the time of death.

If annuity payments have begun, whether or not payments will certainly proceed to a called recipient would depend on the kind of annuity payment chosen. A straight-life annuity payout will certainly spend for the life of the annuitant with repayments stopping upon their fatality. A period-certain annuity pays out for a particular time period, implying that if the annuitant passes away throughout that time, repayments would pass to a beneficiary for the remainder of the specific period.

Table of Contents

Latest Posts

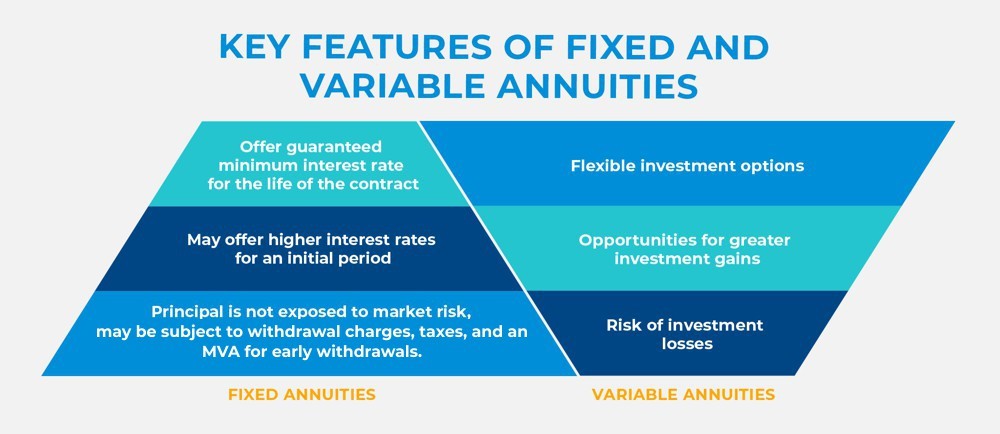

Exploring the Basics of Retirement Options A Closer Look at How Retirement Planning Works Breaking Down the Basics of Deferred Annuity Vs Variable Annuity Advantages and Disadvantages of Different Ret

Breaking Down Your Investment Choices A Comprehensive Guide to Annuity Fixed Vs Variable Defining What Is Variable Annuity Vs Fixed Annuity Benefits of Choosing the Right Financial Plan Why Choosing t

Understanding Fixed Income Annuity Vs Variable Growth Annuity Everything You Need to Know About Financial Strategies What Is Fixed Interest Annuity Vs Variable Investment Annuity? Benefits of Choosing

More

Latest Posts