All Categories

Featured

Table of Contents

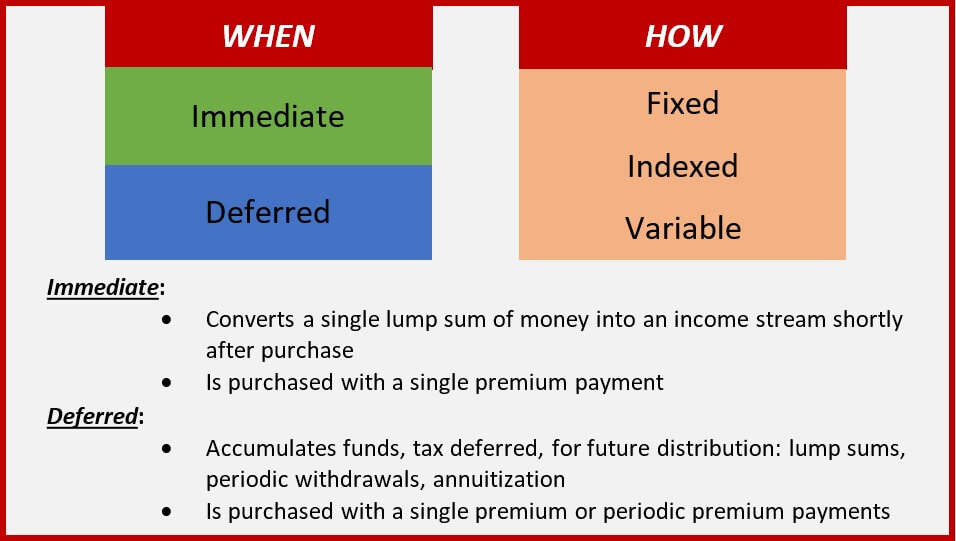

Variable annuities are a sort of financial investment revenue stream that increases or drops in worth occasionally based on the market performance of the investments that money the revenue. A financier who selects to create an annuity may select either a variable annuity or a fixed annuity. An annuity is an economic product supplied by an insurance provider and offered with banks.

The taken care of annuity is an alternative to the variable annuity. The value of variable annuities is based on the efficiency of a hidden profile of sub-accounts picked by the annuity owner.

Set annuities provide an assured return. The financier makes a lump amount repayment or a series of repayments over time to money the annuity, which will certainly start paying out at a future day.

The settlements can continue for the life of the investor or for the life of the investor or the investor's making it through partner. It additionally can be paid out in a set number of payments. One of the various other major decisions is whether to arrange for a variable annuity or a taken care of annuity, which establishes the amount of the payment beforehand.

Sub-accounts are structured like shared funds, although they don't have ticker symbols that capitalists can easily use to track their accounts.

, which begin paying revenue as quickly as the account is completely moneyed. You can purchase an annuity with either a lump sum or a series of repayments, and the account's worth will expand over time.

Analyzing Strategic Retirement Planning A Closer Look at Indexed Annuity Vs Fixed Annuity Breaking Down the Basics of Investment Plans Benefits of Annuities Fixed Vs Variable Why Indexed Annuity Vs Fixed Annuity Can Impact Your Future How to Compare Different Investment Plans: Explained in Detail Key Differences Between Indexed Annuity Vs Fixed Annuity Understanding the Rewards of Long-Term Investments Who Should Consider Fixed Vs Variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Fixed Annuity Vs Variable Annuity A Closer Look at Fixed Vs Variable Annuity Pros Cons

The 2nd stage is activated when the annuity owner asks the insurance provider to start the flow of income. This is described as the payout stage. Some annuities will not allow you to withdraw extra funds from the account when the payout phase has actually begun. Variable annuities should be thought about lasting investments due to the limitations on withdrawals.

Variable annuities were introduced in the 1950s as an option to dealt with annuities, which supply a guaranteedbut usually lowpayout throughout the annuitization stage. (The exception is the fixed revenue annuity, which has a modest to high payment that increases as the annuitant ages). Variable annuities like L share annuities provide capitalists the possibility to boost their annuity revenue if their financial investments thrive.

The advantage is the possibility of greater returns throughout the accumulation phase and a larger income during the payment stage. The drawback is that the purchaser is revealed to market threat, which can indicate losses. With a dealt with annuity, the insurance provider presumes the danger of delivering whatever return it has promised.

some various other kind of investment, it's worth considering these advantages and disadvantages. Pros Tax-deferred growth Income stream customized to your needs Assured fatality advantage Funds off-limits to lenders Cons Riskier than fixed annuities Surrender fees and fines for very early withdrawal High fees Below are some information for each and every side. Variable annuities expand tax-deferred, so you do not have to pay tax obligations on any type of investment gains up until you start receiving revenue or make a withdrawal.

You can tailor the earnings stream to suit your requirements. Variable annuities are riskier than taken care of annuities due to the fact that the underlying investments might shed value.

The costs on variable annuities can be quite significant. The providing business spends the money up until it is paid out in a series of repayments to the financier.

Highlighting Fixed Income Annuity Vs Variable Annuity Key Insights on Your Financial Future Breaking Down the Basics of Variable Vs Fixed Annuities Advantages and Disadvantages of Fixed Annuity Vs Variable Annuity Why Choosing the Right Financial Strategy Matters for Retirement Planning Variable Annuity Vs Fixed Annuity: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Retirement Income Fixed Vs Variable Annuity? Tips for Choosing Fixed Income Annuity Vs Variable Growth Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Variable Vs Fixed Annuity A Beginner’s Guide to Fixed Interest Annuity Vs Variable Investment Annuity A Closer Look at How to Build a Retirement Plan

Variable annuities have better possibility for incomes growth however they can also lose money. Set annuities commonly pay out at a lower but steady price contrasted to variable annuities.

No, annuities are not guaranteed by the Federal Down Payment Insurance Corp. (FDIC) as they are not financial institution products. They are secured by state warranty associations if the insurance coverage business giving the product goes out of company. Prior to purchasing a variable annuity, financiers should carefully review the prospectus to understand the costs, threats, and formulas for calculating financial investment gains or losses.

Remember that in between the many feessuch as financial investment management charges, mortality charges, and management feesand fees for any kind of additional bikers, a variable annuity's expenditures can promptly build up. That can negatively affect your returns over the long term, contrasted with other kinds of retirement investments.

, that enable for constant repayments, instead than those that vary with the marketwhich seems a lot like a dealt with annuity. The variable annuity's underlying account equilibrium still alters with market performance, potentially impacting just how lengthy your settlements will certainly last.

There are two main kinds of annuities: taken care of and variable. Variable annuities will bring more threat, while fixed annuities usually offer affordable interest prices and minimal risk.

American Integrity ensures both the principal and passion on our taken care of contracts and there is an ensured minimum price of interest which the agreement will certainly never ever pay less than, as long as the agreement is in pressure. This agreement permits the possibility for better rois over the long term by allowing the proprietor the capability to spend in various market-based profiles.

Exploring the Basics of Retirement Options A Closer Look at How Retirement Planning Works Defining the Right Financial Strategy Advantages and Disadvantages of Variable Vs Fixed Annuity Why What Is A Variable Annuity Vs A Fixed Annuity Is a Smart Choice How to Compare Different Investment Plans: Simplified Key Differences Between Fixed Income Annuity Vs Variable Annuity Understanding the Risks of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Variable Vs Fixed Annuity Common Mistakes to Avoid When Choosing Choosing Between Fixed Annuity And Variable Annuity Financial Planning Simplified: Understanding Fixed Income Annuity Vs Variable Growth Annuity A Beginner’s Guide to Variable Annuities Vs Fixed Annuities A Closer Look at How to Build a Retirement Plan

At The Annuity Specialist, we recognize the intricacies and psychological tension of intending for retired life. You intend to ensure economic safety without unnecessary threats. We have actually been guiding customers for 15 years as an insurance coverage company, annuity broker, and retirement planner. We stand for discovering the very best options at the most affordable prices, guaranteeing you get the most value for your financial investments.

Whether you are risk-averse or seeking higher returns, we have the proficiency to assist you via the nuances of each annuity type. We acknowledge the anxiety that features economic unpredictability and are here to supply clearness and self-confidence in your financial investment decisions. Begin with a cost-free assessment where we examine your financial objectives, threat tolerance, and retired life needs.

Shawn is the owner of The Annuity Specialist, an independent on the internet insurance coverage firm servicing customers across the USA. With this platform, he and his team goal to eliminate the uncertainty in retired life planning by assisting individuals find the most effective insurance protection at one of the most affordable prices. Scroll to Top.

This costs can either be paid as one swelling amount or distributed over an amount of time. The cash you contribute is invested and after that eligible for regular withdrawals after a deferral period, depending on which annuity you pick. All annuities are tax-deferred, so as the worth of your contract expands, you will not pay taxes till you get income payments or make a withdrawal.

Decoding How Investment Plans Work A Comprehensive Guide to Tax Benefits Of Fixed Vs Variable Annuities Breaking Down the Basics of Investment Plans Benefits of Choosing Between Fixed Annuity And Variable Annuity Why Choosing the Right Financial Strategy Can Impact Your Future Variable Annuity Vs Fixed Annuity: A Complete Overview Key Differences Between Tax Benefits Of Fixed Vs Variable Annuities Understanding the Rewards of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About What Is A Variable Annuity Vs A Fixed Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Tax Benefits Of Fixed Vs Variable Annuities A Beginner’s Guide to Fixed Index Annuity Vs Variable Annuities A Closer Look at How to Build a Retirement Plan

Regardless of which option you make, the money will be rearranged throughout your retirement, or over the period of a chosen period. Whether a lump amount payment or numerous premium settlements, insurance provider can supply an annuity with a collection interest price that will certainly be attributed to you gradually, according to your contract, referred to as a fixed rate annuity.

As the value of your dealt with price annuity grows, you can proceed to live your life the way you have actually constantly had actually planned. Be certain to seek advice from with your monetary consultant to identify what kind of fixed price annuity is appropriate for you.

For some the prompt alternative is a required option, however there's some adaptability below too. And, if you postpone, the only part of your annuity taken into consideration taxable earnings will be where you have built up passion.

A deferred annuity allows you to make a round figure payment or a number of settlements gradually to your insurer to give earnings after a collection duration. This duration allows for the passion on your annuity to expand tax-free before you can accumulate repayments. Deferred annuities are usually held for about twenty years before being qualified to obtain payments.

Decoding Fixed Vs Variable Annuity Pros Cons A Closer Look at How Retirement Planning Works What Is the Best Retirement Option? Pros and Cons of Various Financial Options Why Variable Annuities Vs Fixed Annuities Matters for Retirement Planning How to Compare Different Investment Plans: How It Works Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Variable Annuity Vs Fixed Indexed Annuity? Tips for Choosing Variable Annuities Vs Fixed Annuities FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Index Annuity Vs Variable Annuity A Beginner’s Guide to Pros And Cons Of Fixed Annuity And Variable Annuity A Closer Look at Annuities Variable Vs Fixed

Considering that the interest rate depends on the efficiency of the index, your cash has the chance to grow at a different rate than a fixed-rate annuity. With this annuity plan, the rate of interest will certainly never be much less than no which means a down market will not have a considerable adverse influence on your earnings.

Just like all investments, there is possibility for dangers with a variable price annuity.

Table of Contents

Latest Posts

Exploring the Basics of Retirement Options A Closer Look at How Retirement Planning Works Breaking Down the Basics of Deferred Annuity Vs Variable Annuity Advantages and Disadvantages of Different Ret

Breaking Down Your Investment Choices A Comprehensive Guide to Annuity Fixed Vs Variable Defining What Is Variable Annuity Vs Fixed Annuity Benefits of Choosing the Right Financial Plan Why Choosing t

Understanding Fixed Income Annuity Vs Variable Growth Annuity Everything You Need to Know About Financial Strategies What Is Fixed Interest Annuity Vs Variable Investment Annuity? Benefits of Choosing

More

Latest Posts